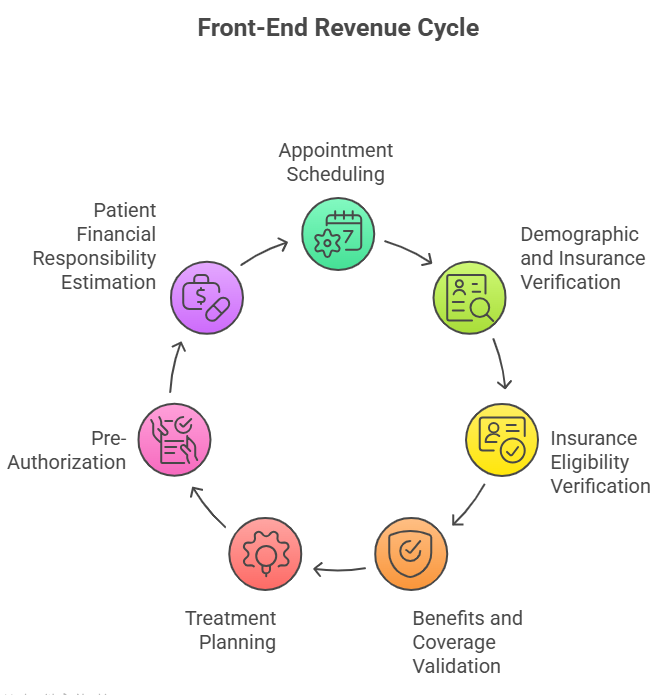

The front-end revenue cycle processes comprise the first phase of dental revenue cycle management (RCM). Steps in this phase determine whether a dental claim is eligible for reimbursement before it’s submitted, and decide if your claims are accurate, while impacting the overall revenue cycle of your practice.

And this is where most dental practices struggle. Half of dental claims are denied due to discrepancies in the front-end phase, such as failed dental insurance verification or missing pre-determination documentation.

But that’s nothing to worry about.

We’ll help you overcome that through this guide, which explains front-end revenue cycle processes, along with their functions, and best practices for efficient management and long-term financial stability.

How Do Front-End Revenue Cycle Processes Matter for Your Dental Practice?

Front-end processes are the administrative, financial, and insurance-related activities. These tasks occur during patient intake and registration, before any clinical dental service is performed.

In dental revenue cycle terms, front-end dental revenue cycle processes ensure that dental claim eligibility, coverage rules, and patient financial responsibility are confirmed upfront.

Accuracy in these front-end operations is highly important for both claim reimbursement and patient satisfaction. If these steps aren’t performed correctly:

- Claims can be denied

- Payments can be delayed

- Reimbursement can be incomplete.

And this is something your practice can’t afford!

But you can prevent that with professional revenue cycle management services.

Want to know how these processes work and make tasks efficient? Let’s discuss in the next section.

Core Front-End Processes

The core processes that complete the front-end of a dental revenue cycle are:

Let’s navigate all these processes in detail, so it assists your practice’s front-end staff, like receptionists/front desk staff, insurance/benefits coordinators, and financial coordinators/patient account representatives, to excel in their responsibilities, impacting your overall revenue cycle.

Appointment Scheduling

A dental revenue cycle begins with appointment scheduling, in which your practice’s front-end staff organizes and manages patient visits. It ensures that each patient receives the right care at the right time with the appropriate provider.

The process begins when a patient requests a visit. Front-desk staff or automated scheduling software collect essential details to plan the appointment efficiently.

Core components of appointment scheduling include:

- Identifying the type of dental procedure required (e.g., cleaning, crown, orthodontics).

- Assigning the patient to the correct provider based on expertise and availability.

- Reserving the appropriate time slot and treatment room.

- Confirming the appointment with the patient and managing reminders.

- Handling cancellations or rescheduling while maintaining schedule efficiency.

Key information collected during appointment scheduling includes:

| Detail | Description |

|---|---|

| Patient Name | Full legal name for record creation and identification. |

| Contact Information | Phone, email, or messaging preferences for confirmations and reminders. |

| Reason for Visit / Procedure | Type of dental service needed (exam, cleaning, restorative procedure). |

| Provider Preference | A specific dentist or hygienist requested by the patient or assigned based on procedure. |

| Preferred Date/Time | Patient’s requested date and time within office availability. |

| Appointment Duration | Estimated time needed for the procedure to book the schedule. |

| Room/Equipment Requirements | Any special equipment needed for the treatment. |

| Prior Visit or Notes | Relevant information from previous appointments to plan efficiently. |

Scheduling appointments accurately makes dental check-ups easier for patients and providers, while ensuring that the revenue cycle runs smoothly.

Demographic and Insurance Verification

It’s the next step in the front-end revenue cycle management, where front-end staff collect and document the patient’s personal, contact, and insurance information. Patient’s official record is created (for first-time patients) or updated (for returning patients) in the dental practice management system, confirming their registration.

A patient provides required information through paper forms, online portals, or direct communication with the front-desk staff. All data is entered exactly as provided by the patient to ensure information is accurate and consistent across records.

The table below describes some of the key details taken from patients related to the demographics and insurance plans:

| Attribute | Description |

|---|---|

| Date of Birth | Used to distinguish patients and maintain accurate records. |

| Gender | Recorded for demographic and administrative purposes. |

| Home Address | Patient’s current residential address. |

| Contact Information | Phone number and email for communication. |

| Insurance Provider Name | Name of the dental insurance company reported by the patient. |

| Policyholder Name | The person under whom the insurance policy is registered. |

| Policy / Member ID | Insurance identification number provided by the patient. |

| Group Number | Employer or plan group identifier, if applicable. |

| Policy Status | Confirms whether the policy is active on the date of service, including effective and termination dates. |

| Plan Type | Identifies the plan structure (PPO, HMO, Indemnity, Medicaid), which determines claim reimbursement rules and referral requirements. |

| Network Participation | Verifies whether the provider is in-network or out-of-network for the patient’s plan. |

| Coordination of Benefits (COB) | Determines primary and secondary coverage order when a patient has multiple insurance plans. |

Insurance Eligibility Verification

Dental insurance eligibility verification confirms that a patient’s dental policy is active and valid on the scheduled date of service. Using validated insurance data, front-end staff verify coverage through:

- payer portals

- communication with insurers

- practice management systems

Verification is performed close to the appointment date, as coverage may change due to employer updates, plan terminations, or nonpayment. In fact, verifying details in real-time can make the process more effective, as you check details on the spot and determine if the patient’s treatment is covered by the dental plan.

If eligibility is verified, it confirms whether the patient can receive the benefits in the plan.

Accurate eligibility verification reduces denials, supports financial transparency, and ensures appropriate next steps in the front-end revenue cycle.

Benefits and Coverage Validation

This determines what services the patient’s active insurance plan will cover. This step focuses on plan rules and limitations tied to specific dental procedures.

The process includes reviewing:

| Benefit | Description |

|---|---|

| Coverage Percentages | Defines the portion of preventive, basic, and major dental services paid by insurance versus patient responsibility. |

| Annual Maximums | Specifies the total benefit amount available per year and the remaining balance for covered services. |

| Deductibles | Indicates the amount the patient must pay out of pocket before insurance benefits apply. |

| Waiting Periods | Identifies the required coverage duration before major or specialty procedures are eligible. |

| Frequency Limitations | Outlines how often specific services (e.g., cleanings, X-rays, crowns) are covered within a given time frame. |

Staff also check for other limitations that apply to the planned treatment, such as:

| Limitation | Description |

|---|---|

| Exclusions | Services or procedures explicitly not covered by the plan, such as cosmetic treatments or experimental procedures. |

| Downgrades | Insurance may pay at a lower level than the procedure performed; for example, covering a crown as a filling. |

| Service-Specific Restrictions | Limitations on specific services, such as coverage only for certain teeth, age restrictions, or frequency limits. |

These benefits and limitations are verified using payer portals, plan summaries, or insurance manuals. The obtained information is documented in the patient’s record for reference during treatment planning and financial discussions.

Accuracy in the verification process ensures treatment recommendations align with the patient’s insurance structure.

Treatment Planning

Once a patient’s eligibility and benefits are verified, front-end staff begin planning treatment by organizing and sequencing dental procedures based on clinical findings and patient needs.

This information helps providers to plan procedures by keeping coverage benefits and limitations in mind.

Treatment planning outlines all the aspects, including:

| Planning Aspect | Description |

|---|---|

| Procedure Selection | Choosing appropriate procedures based on diagnosis, patient needs, and evidence-based clinical guidelines. |

| Sequencing of Care | Determining the optimal order of procedures to maximize outcomes, manage patient comfort, and comply with clinical best practices. |

| Documentation of Clinical Necessity | Recording the medical and dental reasoning for each procedure, including supporting radiographs and treatment notes, to justify care to insurers and maintain compliance. |

| Coordination with Insurance Requirements | Ensuring treatment plans align with payer rules, such as frequency limitations, prior authorization requirements, and coverage restrictions. |

Treatment plans may include single-visit services or multi-phase procedures spread across multiple appointments.

Example: A dental filling may require a single visit, as the cavity is cleaned and filled in one appointment.

But a dental implant with crown restoration may require multiple visits.

- Phase 1 – Implant Placement: Surgical placement of the titanium implant into the jawbone.

- Phase 2 – Healing/Osseointegration: 3-6 months of healing for the implant to fuse with the bone.

- Phase 3 – Abutment Placement: Attaching the connector piece to the implant.

- Phase 4 – Crown Placement: Final restoration of the tooth with a crown, completing the procedure.

Plans are recorded in the practice management system and shared with the patient for review and approval.

These plans are also shared with the insurance company via predetermination request letters, where insurers are requested to provide accurate cost estimates and an overview of what’ll be covered in an insurance plan and what the patient must pay.

Now, to write a predetermination letter, let’s explore the table below.

| Section | Details |

|---|---|

| Patient Information | Full name, date of birth, insurance ID/member number, group number, policyholder name (if different) |

| Provider / Practice Information | Dentist name, credentials, NPI number, practice name, address, phone/email/fax |

| Date of Service | Proposed date(s) for treatment |

| Treatment Plan | CDT codes, procedure descriptions, tooth numbers/quadrants, estimated fees |

| Clinical Justification | Patient’s clinical findings, diagnosis, supporting documentation (radiographs, photos, charts) |

| Purpose of Request | Statement that the request is for predetermination of benefits, not a guarantee of payment |

| Coverage / Benefit Questions | Specific questions regarding coverage, frequency limits, waiting periods, and prior authorization requirements |

| Attachments / Supporting Documentation | Radiographs, photographs, clinical notes, periodontal charts, and other relevant documentation |

| Signature / Contact of Submitting Staff | Name, title, credentials, direct contact info |

Now, we’ll share a template with an example that properly explains how to use the above mentioned information while preparing a predetermination request letter for an insurance company. Example: A patient visits a practice for an overdenture – complete maxillary (D5863). The letter should be written like this:

Subject: Predetermination Request – [Patient Name], DOB: [MM/DD/YYYY], Subscriber ID: [#], Group #: [#], Proposed DOS: [MM/DD/YYYY]

Dear Dental Benefits Review Team,

We are requesting a predetermination of benefits for the proposed treatment listed below. The patient, [Patient Name], has been informed that this request is not a guarantee of payment; however, your review will assist in accurate treatment planning and financial consent.

Treatment Plan:

- D5863 – Overdenture, complete maxillary

- Tooth numbers / quadrants involved: Maxillary arch

- Estimated fees for each procedure: [Insert estimated fee]

- Proposed Date of Service: [MM/DD/YYYY]

Clinical Justification:

Clinical findings include severe maxillary edentulism, insufficient stability with current prosthetics, and progressive bone resorption. The patient presents with these findings as confirmed by diagnostic imaging and clinical evaluation.

Attached X-rays, photographs, and charting provide supporting evidence for the recommended treatment. Without timely care, the patient is at risk for compromised oral function, difficulty with mastication, and continued bone loss.

We respectfully request written confirmation of benefits, coverage limitations, and any required preauthorizations for this procedure. All supporting documentation is enclosed for your review.

Thank you for your prompt attention to this request.

Sincerely,

[Provider Name, Credentials]

[Practice Name]

[Direct Phone / Email]

The treatment plan and predetermination request should be clear, as they provide a proper structure for both clinical care and administrative workflows.

Prior Authorization

Once a dentist establishes a treatment plan based on diagnosis and medical necessity, prior authorization is submitted to the insurance carrier for some high-cost or complex dental procedures to determine whether the proposed services meet coverage criteria.

This step occurs before treatment is rendered and is critical for reducing denials, unexpected patient balances, and delayed reimbursements.

Front-end or insurance coordination staff track authorization status, communicate payer responses, and update financial estimates based on approvals, limitations, or exclusions.

Common dental procedures that often require prior authorization include:

- Crowns and bridges

- Dental implants and implant-supported prosthetics

- Root canal therapy (especially molars)

- Periodontal surgery

- Complete or partial dentures

- Overdentures

- Orthodontic treatment

- Major oral surgery procedures

The criteria vary for each insurance company, so front-end staff must verify if the insurer requires prior authorization for the procedures.

Patient Financial Responsibility Estimation

To estimate a patient’s financial responsibility, front-end staff calculate the portion of treatment costs the patient is expected to pay.

It’s calculated after verifying the patient’s coverage eligibility and benefits and receiving the insurance company’s response to the predetermination letter and/or confirmation on pre-authorization for specific treatments.

Front-end staff determine patients’ out-of-pocket costs by applying insurance coverage percentages to the planned procedures and identifying any remaining balance owed by the patient.

Example:

A patient is scheduled for a crown (CDT D2740) with a total fee of $1,200. Insurance verification shows:

- Major services covered at 50%

- Annual deductible of $100, not yet met

- No frequency limitations affecting coverage

Calculation by front-end staff

- Deductible applied first: Patient pays $100

- Remaining balance: $1,100

- Insurance pays 50% of $1,100 = $550

- Patient responsibility: $100 (deductible) + $550 = $650

These estimates can be prepared manually or electronically via practice management software, and are shared with the patient to review and approve before beginning the procedure. With that, patients can understand their expected costs and make informed decisions.

Once patients approve, consent forms can be provided to the patients to sign, which clearly explain that patients are aware of the associated risks and willing to pay the charges communicated to them. These preventive actions legally protect dental practices.

Impact of Front-End Revenue Cycle on Patient Experience

Strong front-desk revenue cycle operations improve patients’ experience in a lot of ways, while also benefiting your dental practice.

Cost Transparency in Dental Care

Patients know exactly about the total charges of a procedure, as well as the costs covered by their insurance plan, and the charges they need to pay on the counter. helping them plan their budget and decide to receive the treatment.

Fewer Billing Surprises

Accurate estimates and pre-determinations reduce unexpected charges, ensuring patients aren’t caught off-guard by costs they aren’t prepared for. It also helps your practice stay compliant with the No Surprises Act, which requires practices to provide good-faith estimates to patients before a treatment, and they shouldn’t be charged extra.

Clear Financial Communication

Transparent and upfront discussions about treatment costs and insurance coverage build trust, improve patient satisfaction, and streamline payment planning for both patients and the practice. Moreover, a strong trust and clear pre-treatment communication make patients more likely to return to your practice.

Compliance and Documentation Requirements

Staying compliant with state rules and payer policies is a must while handling front-end revenue cycle processes.

To elaborate on it, we’ll share some compliance and documentation requirements you must follow during these steps to protect your practice from audits, while preventing payment delays or claim denials.

Informed Consent Forms

Consent forms are documents in which the patient acknowledges understanding the proposed dental procedure, along with its risks, benefits, and alternatives.

Key components include:

- patient name

- procedure details

- risks

- expected outcomes

- signature/date

They are prepared by the provider and reviewed with the patient before treatment.

They protect both the patient and practice legally while supporting ethical care. Proper documentation of signed consent is essential for audits, insurance reviews, and risk management, particularly for surgical or multi-phase procedures.

Medical Necessity Documentation

Medical necessity documentation explains why a procedure is required, supported by clinical findings, diagnosis, and evidence like X-rays, photos, or charts. Documentation can vary for each procedure.

Details you need to add to this documentation include:

- patient history

- clinical evaluation details

- treatment reason

- supporting documentation

Insurers require this for coverage verification and pre-determination approvals. It’s particularly critical for surgical procedures, implants, and high-value restorative services.

Accurate documentation reduces claim denials, ensures proper coding, and supports audits. So, it’s necessary to prepare the documentation during treatment planning to justify procedures for insurers or audits.

Some complex dental procedures also require prior authorization from insurance companies, so this documentation helps explain the necessity for the treatment to the insurers.

Financial Responsibility Form

This document confirms the patient’s understanding of their personal financial obligations, like co-pays and non-covered services, for a dental treatment. It’s typically signed and completed before treatment begins to ensure transparency and prevent future billing disputes.

The form includes key details like:

- Patient Information: Name, date of birth, insurance ID, and policy details.

- Treatment Costs: Estimates for planned procedures

- Insurance Coverage: Verified benefits, deductible, co-pay, and any non-covered services.

- Payment Agreement: Accepted payment methods, installment options, and signature/date lines.

- Acknowledgment: Statement confirming the patient understands their responsibility and agrees to pay any portion not covered by insurance.

The provider needs to obtain the patient’s acknowledgment and store it in the patient’s record to support audits.

ADA Documentation Requirements

ADA requires you to maintain a complete record of a patient’s treatment and mandates that the treating dentist is responsible for assigning codes to a dental procedure. Moreover, it requires you to submit details that are relevant to the procedure and should not mention other information.

The patient and procedure details you need to enter in the record for front-end processes are:

- Accurate Patient Demographics: Collect and verify patient name, date of birth, address, phone numbers, and employment information. These details are essential for insurance verification and eligibility checks.

- Informed Consent and Authorizations: Obtain and document signed informed consent, waivers, and other authorizations before treatment. Ensures patients understand their obligations and supports compliance.

- Treatment Plan Documentation: Record proposed treatments, discussions about risks, benefits, alternatives, and patient decisions. Front-office staff can reference these notes during insurance verification or financial discussions.

- Clinical Notes Supporting Coverage: Maintain progress notes, diagnostic records (charts, radiographs, study models), and follow-up instructions to substantiate medical necessity for insurer inquiries.

- Record Accuracy and Responsibility: Ensure all entries are signed or initialed. Correctly record procedure codes and details; the dentist is responsible for accuracy, even if entered by staff.

- Separate Financial Documentation: Keep patient financial information (estimates, ledgers, insurance claims) separate from clinical records. Front-end staff manage these records for cost estimates and patient financial discussions.

- Audit and Review: Regularly audit patient records to confirm accuracy, completeness, and compliance with ADA standards. Helps verify that required documentation is collected and correctly recorded while matching with the insurance company’s data, before treatment begins.

HIPAA Compliance Requirements

The Health Insurance Portability and Accountability Act (HIPAA) requires dental practices and insurers to protect patients’ sensitive health information and sets out some requirements, which your front-end staff should follow to stay HIPAA-compliant.

Minimum Necessary Use of PHI

Front-end staff may collect and use patients’ Protected Health Information (PHI) only to the extent necessary to:

- Verify insurance coverage and eligibility

- Prepare treatment estimates and explain financial responsibility

- Submit or support claims and pre-determinations

Information unrelated to billing or payment (such as unnecessary medical history details or personal commentary) should not be collected or documented. (HIPAA: § 164.502(b), § 164.514(d))

Secure Handling of Patient Information

Practices must safeguard PHI in all formats used at the front desk:

- Paper records must be stored securely (e.g., locked cabinets, controlled access).

- Electronic PHI must be protected with passwords, encryption, antivirus software, and screen-privacy controls.

- Access to PHI must be limited to authorized workforce members who need it for revenue cycle duties.

A written security risk analysis is required, along with ongoing risk management to address vulnerabilities involving electronic PHI (ePHI). (HIPAA: § 164.306–§164.312)

Appropriate Patient Financial Communications

When discussing benefits, balances, or insurance information:

- Use secure communication methods whenever possible.

- Avoid disclosing PHI through unsecured email, voicemail, or public conversations.

- Confirm patient identity before discussing account or insurance details.

(HIPAA: §164.502(a), §164.530(c))

Required Notices, Consents, and Acknowledgments

Front-end processes must include:

- Providing and documenting receipt of the Notice of Privacy Practices to the patients, to assure them that their PHI is secured.

- Obtaining signed acknowledgments or consents for treatment, billing, and use/disclosure of PHI for payment purposes.

- Maintaining these documents in the patient record without unnecessary or subjective notes.

(HIPAA: §164.520, §164.506)

Business Associate Agreement

If front-end revenue cycle functions involve third parties (e.g., billing companies, clearinghouses), a compliant Business Associate Agreement (BAA) must be in place before any PHI is shared with any user.

And the practice remains responsible for ensuring PHI is properly protected.

(HIPAA: §164.502(e), §164.504(e))

Staff Training and Accountability

All front-office workforce members, including senior and permanent employees, and trainees, must receive HIPAA training specific to:

- Patient registration

- Eligibility and benefits verification

- Financial discussions and documentation

Training must be documented, and the practice must enforce sanctions for noncompliance.

(HIPAA; §164.530(b), §164.530(e))

Auditing, Monitoring, and Documentation

Practices must periodically review front-end revenue cycle workflows to confirm HIPAA compliance, including:

- Registration and intake processes

- Eligibility verification and pre-authorizations

- Financial estimates and patient communications

Any issues must be corrected promptly, and all compliance documentation (policies, training logs, BAAs, risk analyses) must be retained for at least six years and made available if investigated.

(HIPAA: §164.308(a), §164.530(j))

Payer Requirements

Let’s review the documentation and compliance requirements of different insurance companies for dental front-end revenue cycle processes.

Aetna Dental

- Eligibility and Benefits Verification: Must be completed using payer portals or phone verification before treatment. Verification includes active coverage, plan type, deductibles, annual maximums, and coverage percentages.

- Predetermination (Pretreatment Estimate): Recommended for high-cost or complex procedures (e.g., crowns, prosthodontics) to clarify coverage and patient responsibility before care.

- Accurate Provider and Patient Data: Correct NPI, TIN, subscriber ID, and patient demographics are required for reliable benefit responses.

Cigna Dental

- Eligibility and Benefits Review: Front-end staff should confirm active coverage, plan limitations, and cost-sharing before treatment.

- Predetermination of Benefits: Optional but encouraged for costly or multi-step procedures to estimate insurer payment and patient responsibility.

- Treatment Plan Submission: A treatment plan and supporting clinical documentation (when requested) must match the proposed services to avoid estimate discrepancies.

Delta Dental

- Real-Time Eligibility and Benefits: Providers should use payer portals to verify coverage status, remaining maximums, deductibles, and frequency limits before scheduling treatment.

- Pretreatment Estimates: Recommended for major procedures to confirm benefits and limitations in advance.

United Healthcare

- Eligibility and Benefit Verification: Must be completed via the UHC dental provider portal before treatment; responses are informational and not a payment guarantee.

- Treatment Estimates: Used to communicate expected insurance coverage and patient responsibility before care begins.

Blue Cross Blue Shield

- Eligibility and Network Verification: Coverage, plan type, and network participation must be confirmed prior to treatment using plan-specific portals.

- Predetermination of Benefits: Recommended for prosthetics, periodontal, and other high-cost procedures to determine coverage limits and patient costs.

- Plan Variability Awareness: Front-end staff must review plan-specific benefit summaries, as BCBS requirements vary by state and product.

Keeping up with so many documentation and compliance requirements and mastering different payer portals may overwhelm your practice’s front-end staff.

But that’s where outsourcing your revenue cycle comes into play.

Partnering with reliable RCM partners like TransDental resolves this issue as these companies employ experienced staff, combined with automated processes, for fast and precise front-end revenue cycle management. It not only ensures a proper RCM process but also reduces your staff’s workload.

Common Errors in Front-End Revenue Cycle

Common front-end revenue cycle errors cause revenue losses that can’t be fixed later. Identifying these early can prevent revenue issues. These include:

Skipped Dental Insurance Verification

Skipping dental insurance verification occurs when appointments proceed without confirming whether a patient’s policy is active. This often happens due to staff shortages, manual workload, or assumptions based on past visits. Without verification, inactive or terminated policies may go unnoticed, leading to rejected claims and delayed payments.

Solution

Establish a standard verification process for every scheduled appointment, regardless of patient history. Use payer portals or clearinghouse tools to confirm policy status, effective dates, and network participation close to the date of service.

Automating eligibility checks within practice management systems can reduce manual effort, especially in real-time, to confirm the current stage.

Ignored Dental Plan Frequency Limitations

Dental plan frequency limitations define how often certain procedures, such as cleanings, exams, or X-rays, are covered. When these limitations are ignored, services may be provided outside allowable timeframes. This typically results from incomplete benefits verification or misinterpretation of plan rules.

Solution:

During benefits verification, staff should always review frequency rules tied to specific CDT codes. Maintaining a reference guide within the system for common procedures helps reduce errors.

Recording the last date of service and frequency restrictions in the patient’s profile ensures future appointments align with plan limits. Clear documentation prevents repetitive checks.

Missing Pre-Determinations

Pre-determinations are often required for major dental procedures. Missing them occurs when staff fail to identify procedures needing advanced review or underestimate payer requirements. This leads to uncertainty around coverage and increased financial risk for both the practice and the patient.

Solution

Create a checklist of procedures that commonly require pre-determinations. Train staff to identify these services during treatment planning. Submitting pre-determinations early allows sufficient review time and provides documented payer responses. Tracking submission status within the system ensures follow-ups are completed before treatment begins.

Poor Pre-Treatment Financial Workflows

Poor pre-treatment financial workflows arise when cost estimates are inaccurate or not communicated clearly. This often results from incomplete benefits validation, manual calculation errors, or a lack of standardized estimation processes. Patients may be surprised by charges after treatment.

Solution

Standardize patient financial responsibility estimation using verified benefits and treatment plans. Utilize software tools that calculate estimates based on coverage percentages and remaining maximums.

Present written estimates before treatment and document patient acknowledgment. Clear workflows improve transparency and reduce disputes.

Best Practices to Optimize Front-End Revenue Cycle Management

Standardize all the steps and workflows in the front-end dental revenue cycle to improve your outcomes such as clean claims submission, maximum collections, and fewer claim denials, which are a part of mid-cycle and back-end stages in the revenue cycle.

Here, we’ll discuss best practices that’ll help optimize your revenue cycle.

Develop Standard Operating Procedures (SOPs)

Document step-by-step workflows for all the front-end steps, including:

- patient intake and registration

- eligibility, benefits, and insurance verification

- financial estimation

- point-of-service collections

Documented SOPs help your staff to consistently review the defined regulations and follow them while managing the front-end revenue cycle. This also helps with effective A/R management, as you verify patient coverage on time to accurately submit claims and charge patients timely.

Plus, it’s a good practice to assign responsibilities to your front-end staff and define timelines for each step. The table below features examples of role assignment for each of your staff members, along with set timelines. Note: It’s just an example of how you can assign responsibilities and timelines for each front-end step. Your practice criteria can be different.

| Step | Staff Responsible | Timeline / Frequency | Notes |

|---|---|---|---|

| Patient Registration | Front Desk / Receptionist | At first patient contact / each appointment | Collect demographics, contact info, and insurance details; verify eligibility. |

| Insurance Eligibility Verification | Front Desk / Insurance Coordinator | Before appointment (ideally 24–48 hours prior) | Confirm coverage, plan type, network participation, deductibles, and annual maximums. Document in the system. |

| Pre-Determination / Pretreatment Authorization | Insurance Coordinator / Billing Specialist | Submit 1–2 weeks before treatment | Prepare request with CDT codes, tooth numbers, clinical notes, and supporting radiographs. Track responses. |

| Financial Estimate and Patient Discussion | Front Desk / Financial Coordinator | Same day as treatment scheduling | Present expected patient responsibility, payment options, and obtain signed acknowledgment/consent forms. |

| Consent and Documentation | Front Desk / Clinical Staff | Before the procedure | Ensure informed consent, HIPAA acknowledgment, and financial responsibility forms are signed and recorded. |

| Point-of-Service Collections | Front Desk / Financial Coordinator | At appointment | Collect co-pays, deductibles, or partial payments; post payments immediately in practice management software. |

| Front-End Audit / Quality Check | Office Manager / Lead Front Desk | Weekly or daily close-of-day | Review registrations, eligibility checks, pre-determination status, and documentation completeness. Correct errors immediately. |

Use Standardized Forms and Templates

Create:

- registration forms

- insurance verification checklists

- pre-determination request templates

- financial responsibility forms

Using these pre-built forms and templates makes it easier to modify and utilize them for communicating with patients or insurers when required. It saves time, reduces errors. and ensures all required data is collected consistently.

Implement Practice Management Software

Utilize robust software, like TransDental’s practice management solutions, for automating all the front-end processes to complete tasks like appointment scheduling and eligibility checks in seconds and with near accuracy.

These tools are viable solutions, as compared to relying on manual processes or legacy systems, which consume time, are prone to errors, and may also not perform according to constantly changing payer requirements and other updates.

Train Staff Consistently

Provide structured training manuals and regular refreshers for front-office staff. The table below describes some of the resources your staff consistently needs to stay current with updates and complete tasks efficiently.

| Training Resource | Purpose / Focus | Description | Use in Practice |

|---|---|---|---|

| SOP Manual | Standardize front-end workflows | Step-by-step procedures for patient intake, registration, insurance verification, pre-determinations, and point-of-service collections | Daily reference for staff to ensure consistent processes and reduce errors |

| Payer-Specific Guides | Ensure compliance with insurance rules | Eligibility verification steps, pre-determination requirements, documentation checklists; includes private insurers like Aetna, Delta Dental, Cigna, UnitedHealthcare, and BCBS | Prevent claim denials and ensure consistent adherence to payer requirements |

| HIPAA Compliance Guide | Protect patient information | Handling of PHI, privacy standards, secure communication, and documentation requirements | Ensure front-end staff handle patient data securely and legally |

| Communication Scripts and Templates | Clear financial and insurance communication | Sample scripts for presenting cost estimates, creating payment plans, discussing coverage, and handling patient questions | Train staff to explain insurance benefits, patient responsibility, and collections professionally |

| Practice Management Software Manual | Efficient software usage | Tutorials for scheduling, eligibility checks, claim submission, payment posting, and error resolution | Hands-on guidance for staff to navigate software effectively |

| Checklists and Quick Reference Sheets | Streamline front-end tasks | Intake checklists, verification forms, pre-determination templates, and financial consent forms | Day-of-appointment reference to ensure all steps are completed accurately |

Establish Quality Control Measures

Conduct regular audits of patient intake, eligibility verification, and pre-determination submissions.

Monitor KPIs and Metrics

- Track metrics such as insurance verification accuracy, pre-determination approval rates, and point-of-service collections.

- Use results to refine workflows and reinforce standardized practices.

Outsource Front-End Tasks

Since managing all the front-end tasks, consistently adapting to new regulations via training, doing these quickly, and keeping track of all the payer compliance rules isn’t possible for your staff.

Furthermore, learning these tools can also take time, especially for staff members who aren’t tech-savvy.

In that case, the best way to streamline front-end task management is to outsource your revenue cycle management to companies like TransDental, which offer a complete revenue cycle management suite, combined with RPA and AI technology to ensure accuracy and quick task completion.

KPIs in Front-End Revenue Cycle

Key performance indicators (KPI) or metrics to evaluate the performance of a front-end revenue cycle are:

Eligibility Verification Rate

The eligibility verification rate reflects how accurately your front-end staff verify a patient’s active coverage before treatment. It depends on precisely confirming the following details at scheduling or check-in:

- plan status

- effective dates

- network participation

- basic benefit details

Strong eligibility verification reduces claim rejections, prevents treatment delays, and ensures services are rendered only when coverage is active and identifiable.

Registration Accuracy

Registration accuracy measures how correctly patient and subscriber information is captured at the front end. This includes:

- patient demographics

- subscriber details

- policy numbers

- group numbers

- provider identifiers

Accurate registration supports clean eligibility checks, reliable benefit estimates, and successful claim submission, reducing claim denials caused by data mismatches or missing information.

Pre-Determination Approval Rate

Pre-determination approval rate tracks how often submitted treatment plans receive favorable benefit estimates from insurers before care begins. It reflects the quality of:

- front-end documentation

- correct CDT coding

- complete clinical information submitted with estimates

Higher approval rates improve financial predictability, reduce patient disputes, and support informed consent and treatment acceptance.

Point-of-Service Collections

Point-of-service collections represent the portion of patients’ out-of-pocket costs collected at or before the appointment. This relies on accurate eligibility verification, benefit interpretation, and clear cost estimates prepared at the front end, and patient responsibilities communicated upfront.

Effective point-of-service collections reduce patient AR, improve cash flow, and minimize billing follow-up after treatment.

Conclusion

Front-end revenue cycle processes are the most important phase of the dental revenue cycle. Your entire claim submission and the level of coding accuracy rely on proper patient intake, insurance verification, and benefits validation.

By strengthening front-end dental revenue cycle management, your practice can reduce denials, improve cash flow, enhance patient experience, and protect long-term financial health.

Frequently Asked Questions (FAQs)

What is the front-end dental revenue cycle?

The front-end revenue cycle covers all administrative tasks before treatment begins, including patient registration, insurance verification, pre-determinations, financial counseling, and consent forms. Its goal is to ensure eligibility, minimize claim denials, and provide accurate cost estimates to patients.

Why is insurance verification important?

Insurance verification confirms a patient’s coverage, benefits, deductibles, and frequency limits before treatment. This prevents claim denials, reduces unexpected patient bills, and allows staff to provide accurate financial estimates.

What is a pre-determination, and is it part of the front-end cycle?

A pre-determination (or pre-treatment estimate) is a request to the insurance company for a review of coverage for planned procedures. It’s considered a front-end task because it occurs before treatment to confirm benefits and reduce billing surprises.

How does front-end staff handle patient financial responsibility?

Staff calculates patient out-of-pocket costs using verified insurance benefits, deductibles, annual maximums, and co-pays. They then present an estimate, discuss payment options, and obtain signed acknowledgment or financial consent forms.

What are common errors in front-end RCM that affect collections?

Frequent mistakes include incorrect patient demographics, outdated insurance information, failure to check eligibility or frequency limits, missing pre-determinations, and incomplete documentation. Each can lead to claim denials, delayed payment, or patient disputes.

How can dental practices optimize front-end RCM?

Optimization involves standardized registration processes, automated insurance verification tools, staff training on coding and workflows, use of pre-determinations, point-of-service collections, and regular audits to ensure accuracy and efficiency.