Dental claim denials are one of the most frustrating challenges facing dental practices today. When claims get rejected, it creates a domino effect: delayed revenue, administrative burden, patient confusion, and strained relationships. Understanding why dental insurance claims get denied and how to prevent these denials can dramatically improve your practice’s revenue cycle and patient satisfaction.

This comprehensive guide explores the top 10 reasons dental claims get denied and provides actionable solutions to fix them. Whether you’re a dental office manager, billing specialist, or practice owner, these insights will help you reduce denials and optimize your revenue stream.

Why Dental Claim Denials Matter

Claim denials impact your practice in multiple ways. They reduce your revenue, increase administrative costs, delay payment, frustrate staff, and create confusion for patients who may receive unexpected bills. When claims are denied, your team must spend valuable time investigating the issue, correcting errors, and resubmitting claims. This process diverts resources away from patient care and practice growth.

Moreover, denied claims can damage patient relationships. Patients often don’t understand insurance complexities and may blame your practice when they receive unexpected bills. This confusion can lead to payment delays, disputes, and even lost patients.

Top 10 Reasons Dental Claims Get Denied

1. Missing or Incorrect Patient Information

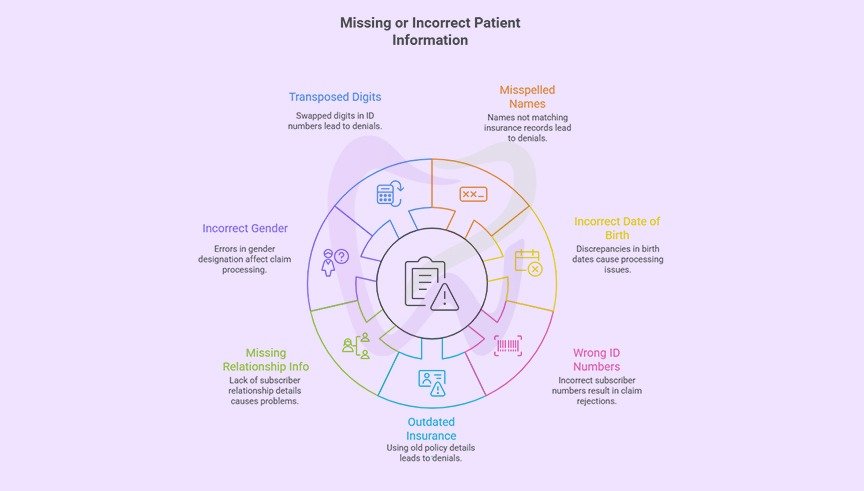

Missing or incorrect patient demographic information is one of the most common reasons for dental claim denials. Insurance companies require precise patient data to process claims, and even minor discrepancies can trigger automatic denials.

Common errors include

- Misspelled patient names that don’t match insurance records

- Incorrect date of birth entries

- Wrong subscriber identification numbers

- Outdated insurance information from policy changes

- Missing subscriber relationship information (self, spouse, dependent)

- Incorrect gender designations

- Transposed digits in ID numbers

How to fix it

Implement a verification protocol at every patient visit. Train your front desk staff to verify insurance information at each appointment, not just the first visit. Make it a policy to photocopy both sides of the insurance card and compare the information against your practice management system.

Use electronic eligibility verification tools to confirm coverage in real-time before providing services. These tools can identify discrepancies immediately, allowing you to correct them before the appointment begins. Create a standardized checklist for patient registration that includes all required fields, and consider implementing double-entry verification for critical data like ID numbers.

Additionally, send appointment reminders that ask patients to inform you of any insurance changes. Many patients switch jobs or plans but forget to update their dental office. Making this a routine part of your communication strategy can prevent many claim denials.

2. Treatment Not Covered Under the Patient’s Plan

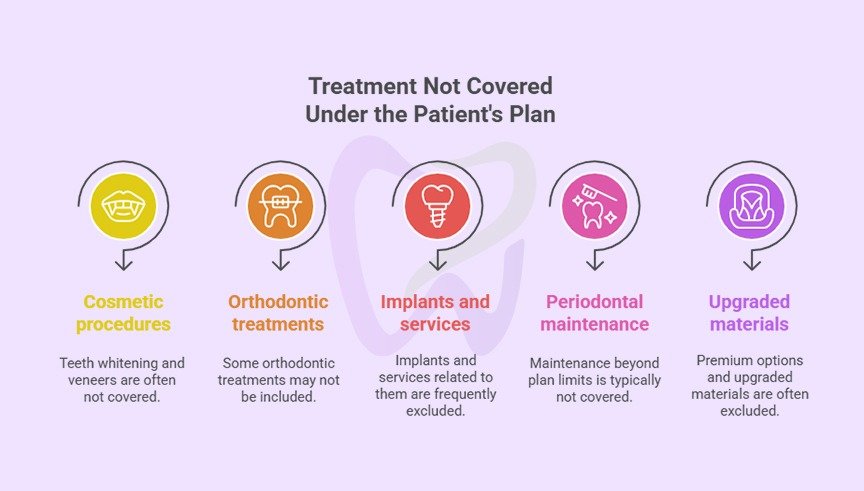

Insurance policies vary significantly in what they cover. What’s covered under one plan may not be covered under another, even from the same insurance company. Submitting claims for non-covered services is a frequent cause of denials.

Common non-covered services include

- Cosmetic procedures like teeth whitening or veneers

- Certain orthodontic treatments

- Implants and related services

- Periodontal maintenance beyond plan limits

- Upgraded materials or premium options

How to fix it

Before recommending treatment, verify what the patient’s specific plan covers. Don’t assume coverage based on what other patients’ plans include. Use your practice management software to track common coverage limitations for different insurance companies and plan types.

When presenting treatment plans, clearly distinguish between covered and non-covered services. Provide patients with a detailed breakdown showing estimated insurance coverage, patient responsibility, and any out-of-pocket costs for non-covered items. Having patients sign a financial agreement acknowledging their responsibility for non-covered services protects your practice and sets clear expectations.

Consider creating a coverage database for frequently seen insurance plans at your practice. Document common limitations, exclusions, and waiting periods so your team can quickly reference this information during treatment planning. This proactive approach helps prevent surprises for both your practice and your patients.

3. Services Not Deemed Medically Necessary

Insurance companies may deny claims for services they consider not medically necessary, even if the service is covered under the plan. This is particularly common with preventive services performed more frequently than plan guidelines allow or with treatments that insurers deem premature or excessive.

Examples include

- Multiple cleanings beyond the allowed frequency

- Full mouth debridement when a regular cleaning would suffice

- Crowns when fillings might be adequate

- Radiographs taken more frequently than guidelines recommend

- Periodontal maintenance before sufficient time has elapsed

How to fix it

Document the medical necessity of recommended treatments thoroughly in your clinical notes. When services exceed standard frequencies or fall outside typical protocols, your documentation should clearly explain why the service is necessary for this specific patient’s oral health.

Include relevant clinical findings, patient history, risk factors, and professional judgment in your notes. For example, if you’re recommending a third cleaning for a patient with active periodontal disease, document the pocket depths, bleeding on probing, bone loss, and patient compliance issues that justify additional care.

Submit detailed narratives with claims that might be questioned. A well-written narrative explaining the clinical rationale can make the difference between approval and denial. Include periodontal charting, radiographs, and photographs when they support your case for treatment necessity.

Familiarize yourself with common insurance guidelines for frequency limitations and medical necessity criteria. Understanding what insurers expect helps you document appropriately and choose procedure codes that accurately reflect the care provided.

4. Incorrect Procedure Codes

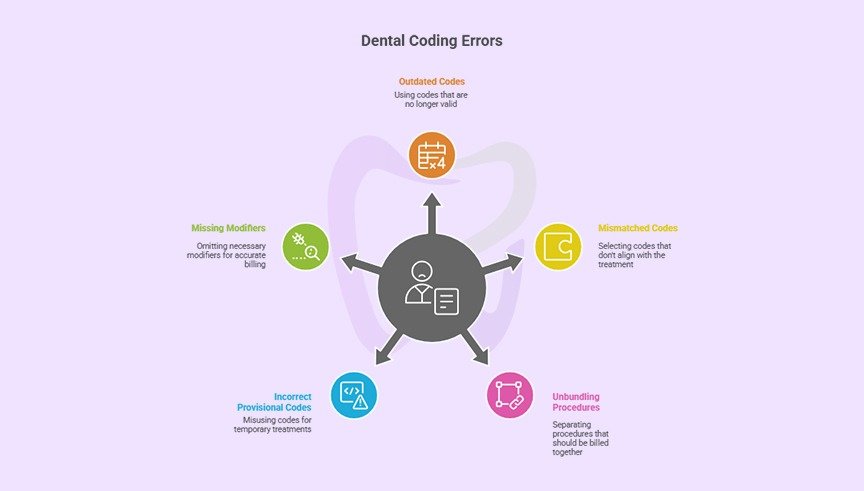

Using incorrect Current Dental Terminology (CDT) codes is a major source of claim denials. Procedure coding errors can occur due to outdated code knowledge, misunderstanding of code definitions, or selecting codes that don’t match the documented treatment.

Common coding mistakes include

- Using deleted or outdated codes

- Selecting codes that don’t match the treatment provided

- Unbundling procedures that should be billed together

- Incorrect use of provisional codes

- Missing required modifiers

How to fix it

Stay current with CDT code updates, which occur annually. The American Dental Association releases new codes and revises existing ones each year, typically taking effect on January 1st. Subscribe to coding updates and ensure your practice management software is updated promptly.

Invest in ongoing training for staff responsible for coding. Understanding the nuances of dental coding requires continuous education. Consider designating a coding specialist within your practice or outsourcing to an expert dental billing and coding service.

Implement a coding audit process to catch errors before claims are submitted. Regular internal audits can identify patterns of coding mistakes, allowing you to address them through additional training or process improvements. Many practices benefit from periodic external audits by coding professionals who can provide objective feedback.

Create coding reference guides for commonly performed procedures at your practice. Quick reference sheets help ensure consistency and accuracy across your team, especially when training new staff members.

5. Missing or Insufficient Documentation

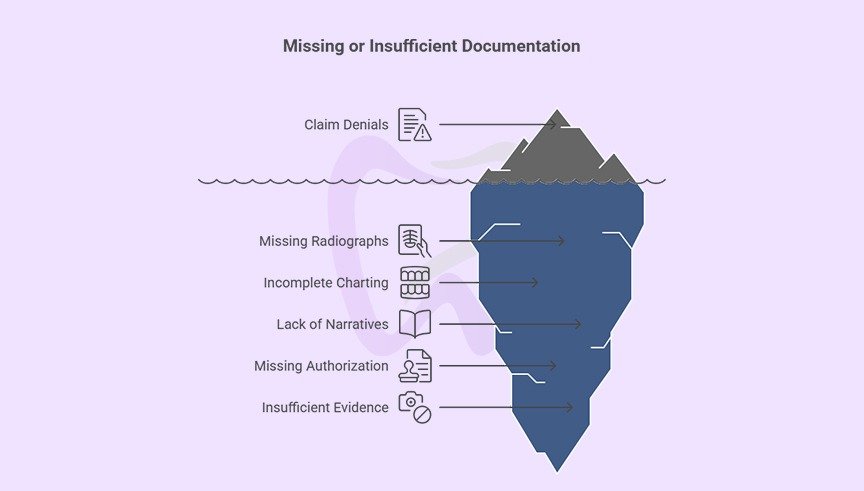

Insurance companies require adequate documentation to support claims, particularly for more complex or expensive procedures. When documentation is missing, incomplete, or insufficient, claims are often denied pending additional information.

Documentation issues include

- Missing radiographs required for certain procedures

- Incomplete periodontal charting for periodontal claims

- Lack of clinical narratives explaining treatment necessity

- Missing pre-authorization documentation

- Insufficient photographic evidence for prosthetic work

How to fix it

Establish clear documentation standards for all procedures. Create checklists specifying what documentation is required for different types of treatments. For example, crown claims typically require pre-operative radiographs showing the need for restoration, while periodontal claims need comprehensive charting.

Train your clinical team to document thoroughly during the patient visit. Contemporaneous documentation is more credible and easier to complete than trying to recreate records after the fact. Make documentation quality a regular topic in team meetings, highlighting examples of excellent documentation and areas for improvement.

Use digital radiography and intraoral cameras to easily capture and attach supporting documentation to claims. Digital images can be quickly incorporated into electronic claims, reducing the time and effort required to provide supporting materials.

When pre-authorization is required, maintain organized records of the authorization including the approval number, date, approved procedures, and any conditions or limitations. Reference this information when submitting the claim to demonstrate compliance with insurance requirements.

6. Exceeding Frequency Limitations

Most dental insurance plans limit how frequently certain procedures can be performed and covered. Submitting claims for services performed before the allowed time period has elapsed results in predictable denials.

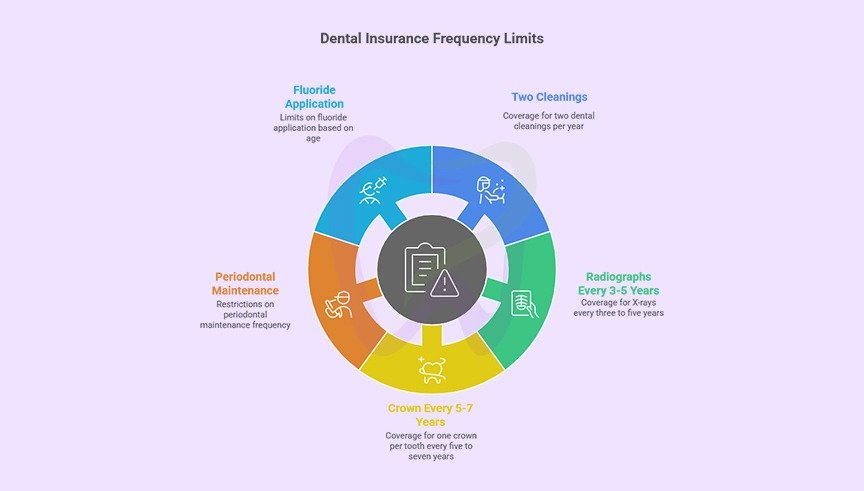

Common frequency limitations include

- Two cleanings per calendar year or rolling 12 months

- One complete series of radiographs every three to five years

- One crown per tooth every five to seven years

- Periodontal maintenance frequency restrictions

- Fluoride application limits based on age

How to fix it

Track service history meticulously in your practice management system. When scheduling appointments, check when the patient last received similar services and whether sufficient time has elapsed for insurance coverage. Most practice management systems can track frequency limitations and alert staff when services may not be covered.

Communicate clearly with patients about frequency limitations during treatment planning and scheduling. Explain that while you recommend certain services based on clinical need, their insurance may not cover them if performed too soon. Give patients the option to proceed with services as out-of-pocket expenses if they’re outside coverage parameters.

Submit claims with clear notation when services are clinically necessary despite falling outside typical frequency guidelines. Include documentation explaining why accelerated treatment is warranted. Some insurers will make exceptions for medical necessity, particularly when clinical conditions have changed significantly.

Create a recall system that aligns with insurance frequency limitations while still meeting clinical needs. For example, schedule patients for cleanings slightly before their insurance benefit period resets to maximize coverage while maintaining appropriate care intervals.

7. Coordination of Benefits Issues

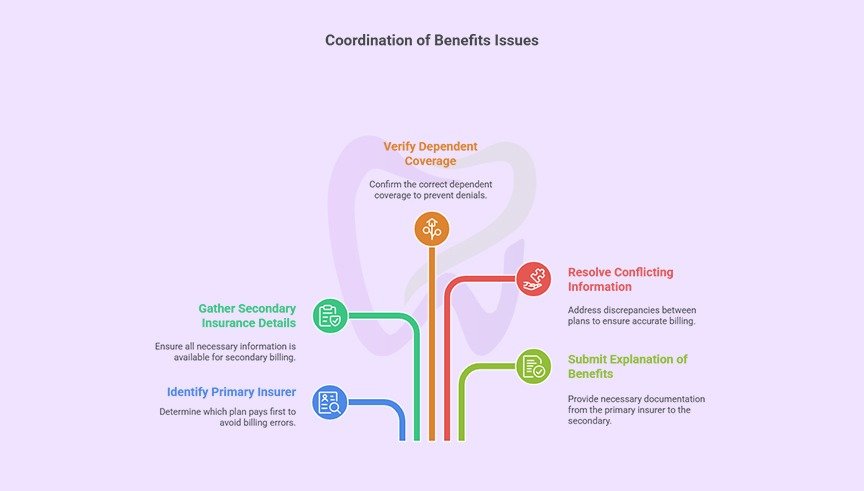

When patients have coverage under multiple dental insurance plans, coordination of benefits (COB) determines which plan pays first (primary) and which pays second (secondary). COB errors are a significant source of claim denials, particularly when the wrong insurance is billed first or when required information is missing.

COB challenges include:

- Filing claims to the wrong insurance company first

- Missing information about secondary insurance

- Incorrect dependent coverage designation

- Conflicting information between plans

- Failure to submit explanation of benefits from primary insurer to secondary

How to fix it

Collect complete information about all insurance coverage at every visit. Don’t assume COB hasn’t changed since the last visit. Life events like marriage, divorce, job changes, or dependent aging out of plans can affect COB.

Understand COB rules to determine which plan is primary. Generally, for children covered under both parents’ plans, the birthday rule applies: the plan of the parent whose birthday comes first in the calendar year is primary. For patients with coverage through their own employer and their spouse’s employer, their own plan is typically primary.

When submitting to secondary insurance, always include the explanation of benefits (EOB) from the primary insurer. Secondary insurers need to see what the primary paid before determining their portion of responsibility. Missing this documentation is a common reason secondary claims are denied or delayed.

Use electronic COB verification tools when available. Many clearinghouses and practice management systems can automatically identify secondary coverage and verify COB, reducing manual errors and ensuring claims are submitted to the correct payer in the proper sequence.

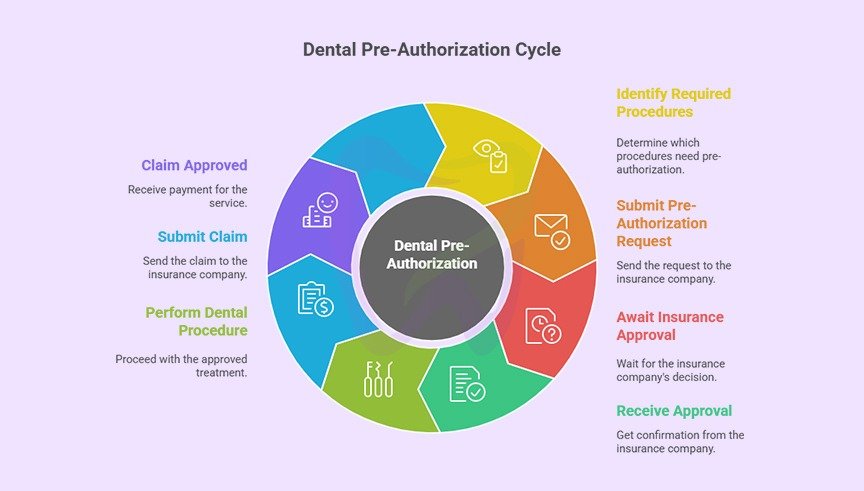

8. Pre-Authorization Not Obtained

Many dental procedures require pre-authorization from the insurance company before treatment begins. Performing services without obtaining required pre-authorization often results in claim denials, even when the treatment is covered under the plan.

Procedures commonly requiring pre-authorization include:

- Crowns, bridges, and other major restorative work

- Orthodontic treatment

- Periodontal surgery

- Dental implants

- Root canals on certain teeth

- Dentures and partial dentures

How to fix it

Familiarize yourself with pre-authorization requirements for the insurance companies you frequently work with. Create a reference guide listing which procedures require pre-authorization for each major insurer. This helps your team quickly identify when pre-authorization is needed during treatment planning.

Submit pre-authorization requests immediately after treatment is recommended and accepted by the patient. Include all required documentation, clinical notes, radiographs, and narratives to support the request. The more complete your submission, the faster the pre-authorization process.

Track pre-authorization requests systematically. Maintain a log of submitted requests, follow up on pending authorizations, and ensure you receive written approval before proceeding with treatment. Document the authorization number, approved amount, approved procedures, and any conditions or limitations.

Communicate pre-authorization timelines clearly with patients. Explain that certain treatments require insurance approval before beginning and that this process typically takes one to three weeks. Setting appropriate expectations prevents patient frustration when treatment must be delayed pending authorization.

Don’t assume that pre-authorization guarantees payment. While pre-authorization indicates the insurer considers the treatment necessary and covered, final payment is subject to eligibility at the time of service and other policy provisions. Inform patients that pre-authorization is an estimate, not a guarantee of payment.

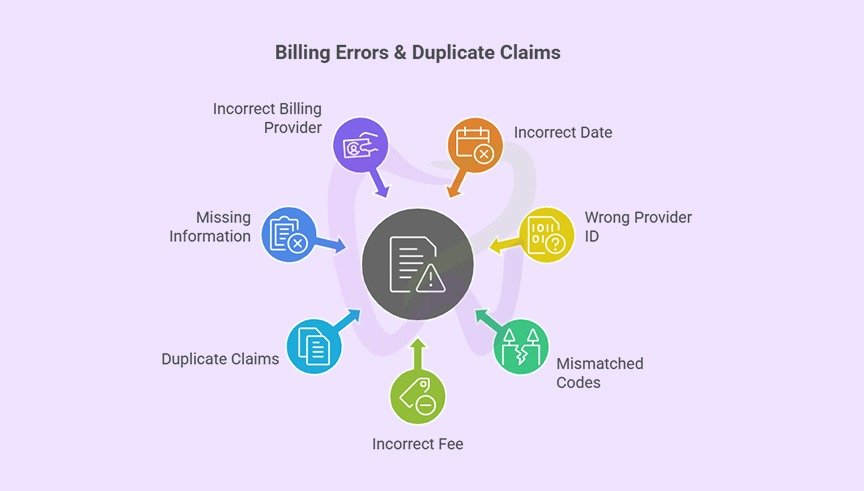

9. Billing Errors and Duplicate Claims

Administrative errors in the billing process frequently cause claim denials. These mistakes range from simple typos to submitting duplicate claims for the same service, which insurers automatically reject.

Common billing errors include

- Incorrect date of service entries

- Wrong provider identification numbers

- Mismatched procedure and diagnosis codes

- Incorrect fee amounts

- Duplicate claim submissions

- Missing place of service information

- Incorrect billing provider information

How to fix it

Implement a claim review process before submission. Have a second team member review claims for accuracy, focusing on dates, codes, provider information, and fee amounts. This extra check catches many errors that would otherwise result in denials.

Use claim scrubbing software to identify errors before submission. Most practice management systems and clearinghouses offer scrubbing features that check claims against common denial triggers and insurance company requirements. These tools can identify issues like invalid code combinations, missing information, or formatting errors.

Maintain detailed claim submission logs to track what’s been submitted and when. This prevents duplicate submissions and helps you quickly identify and follow up on unpaid claims. Your practice management system should maintain a comprehensive claims history, but supplementing this with tracking spreadsheets can provide additional oversight.

Train your billing staff thoroughly on proper claim submission procedures. Ensure they understand insurance requirements, proper coding, and how to use your practice management system effectively. Regular training updates keep skills sharp and introduce best practices.

When denials occur due to billing errors, analyze the root cause and implement process improvements to prevent recurrence. If certain types of errors happen repeatedly, it indicates a training need or a flaw in your workflow that requires correction.

10. Untimely Filing

Insurance companies impose strict deadlines for claim submission, known as timely filing limits. Claims submitted after the deadline are automatically denied, regardless of whether the service was covered. Timely filing limits vary by insurer but typically range from 30 days to one year from the date of service.

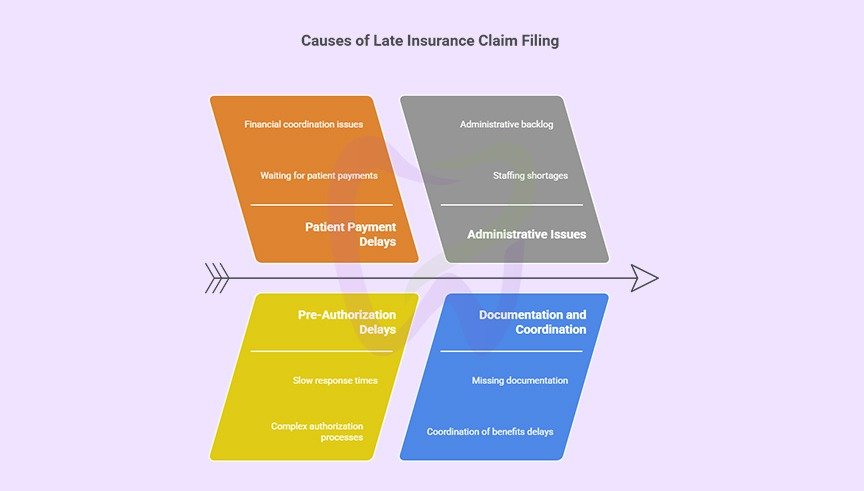

Reasons for late filing include:

- Waiting for patients to pay their portion before filing insurance

- Delays in receiving pre-authorization responses

- Administrative backlog and staffing shortages

- Missing documentation that takes time to obtain

- Coordination of benefits delays

- Filing to the wrong insurance company first

How to fix it:

File claims as quickly as possible after services are rendered. The best practice is to submit claims within 24-48 hours of the patient visit. Electronic claim submission makes same-day filing achievable for most practices, eliminating the backlog that occurs with paper claims.

Know the timely filing limits for each insurance company you work with. Create a reference chart listing these deadlines and make it easily accessible to your billing team. Set internal deadlines well before the insurance deadline to provide a buffer for resolving issues.

Never delay filing claims because a patient hasn’t paid their portion. File the insurance claim immediately and bill the patient separately for their responsibility. Waiting for patient payment puts your practice at risk of missing filing deadlines and losing the entire insurance portion of payment.

Implement a claims follow-up system to track pending claims and identify those requiring attention. Most practice management systems can generate aging reports showing claims that haven’t been paid within expected timeframes. Review these reports regularly and follow up on claims approaching timely filing deadlines.

When you know a claim will be filed late due to unavoidable circumstances, contact the insurance company to explain the situation. Some insurers will grant exceptions for late filing when there are extenuating circumstances, particularly if you communicate proactively rather than waiting for an automatic denial.

Preventing Dental Claim Denials: Best Practices

Creating systems and workflows that prevent denials from occurring in the first place is far more efficient than dealing with denials after the fact.

Implement these best practices:

Verify insurance eligibility before every appointment. Don’t rely on information collected weeks or months earlier. Real-time verification ensures you have current coverage details and can identify issues before services are rendered.

Collect accurate patient information at every visit. Make it standard practice to ask patients to confirm their demographic and insurance information at each appointment, not just new patient visits. People change jobs, move, and update insurance regularly.

Train staff continuously on coding and billing. Dental billing and coding evolve constantly with new codes, updated insurance policies, and changing regulations. Invest in ongoing education for your administrative team through webinars, conferences, and professional resources.

Use technology to your advantage. Modern practice management systems, clearinghouses, and verification tools can automate many aspects of the claims process, reducing human error and improving efficiency. Electronic claim submission is faster, more reliable, and easier to track than paper claims.

Document thoroughly and accurately. Clinical documentation should support the necessity and appropriateness of all treatments. Train your clinical team to document with the understanding that their notes may be reviewed by insurance companies as justification for coverage.

Establish clear financial policies. Ensure patients understand their financial responsibility upfront. Collect estimated patient portions before or at the time of service when possible. Clear financial policies reduce confusion and disputes while improving cash flow.

Monitor claim metrics regularly. Track your denial rate, common denial reasons, days in accounts receivable, and claim resolution time. These metrics reveal patterns and opportunities for improvement. Regular analysis helps you address problems before they become chronic issues.

Outsource when appropriate. If your practice struggles with consistent claim denials despite improvement efforts, consider partnering with a professional dental billing service like TransDental. Professional billing companies have specialized expertise, dedicated resources, and proven systems for minimizing denials and maximizing collections.

Frequently Asked Questions (FAQs)

What’s the difference between a claim denial and a claim rejection?

A claim rejection occurs before the claim is processed, typically due to technical errors like missing information or incorrect formatting. Rejections are usually caught immediately by the clearinghouse or insurance system. A claim denial, on the other hand, happens after the insurance company has reviewed the claim and determined it’s not eligible for payment based on policy terms, coverage limitations, or other substantive reasons. Rejections can usually be corrected and resubmitted quickly, while denials require investigation, documentation, and often formal appeals.

What percentage of dental claims get denied?

Industry data suggests that approximately five to ten percent of dental claims are initially denied, though this varies significantly by practice. Well-managed practices with strong verification procedures, accurate coding, and thorough documentation can achieve denial rates below five percent. Practices struggling with claim management may see denial rates of fifteen percent or higher, significantly impacting revenue and administrative burden.

How long do I have to appeal a denied dental claim?

Appeal deadlines vary by insurance company but typically range from 30 to 180 days from the date of denial. Some insurers allow as little as 30 days, while others provide up to six months or a year. Check the explanation of benefits or denial letter for specific appeal deadlines, as missing these deadlines eliminates your ability to recover payment. It’s best practice to initiate appeals within 30 days of receiving a denial to ensure adequate time for the review process.

Can I bill the patient if their insurance denies the claim?

Your ability to bill the patient after a claim denial depends on several factors including the denial reason, your contract with the insurance company, and what financial agreements you have with the patient. If you’re in-network with the insurance company, you may be contractually prohibited from billing patients for certain denied services. If the denial is due to lack of medical necessity or a non-covered service that the patient agreed to in advance, you can typically bill the patient. Always review your provider agreement and ensure you have written financial agreements with patients before services are rendered, especially for treatments that may not be covered.

What should I do if a claim is denied for timely filing?

Timely filing denials are challenging because they’re often considered final. However, you have several options. First, verify that the claim was actually filed late by checking your submission records. If you have proof of timely filing, submit this documentation with your appeal. Second, if the delay was caused by the insurance company such as requesting additional documentation that took months to process, explain this in your appeal with supporting evidence. Some insurers will grant exceptions for extenuating circumstances. Third, if the patient had other insurance that should have been billed first and caused the delay, document this coordination of benefits issue. Finally, implement systems to prevent future timely filing denials by filing claims within 24 to 48 hours of service.

How do I know if a procedure requires pre-authorization?

Pre-authorization requirements vary by insurance company and plan. Check the patient’s specific insurance policy documents, which should list procedures requiring pre-authorization. Most insurance companies also provide this information on their provider portals or through their provider services phone lines. Common procedures requiring pre-authorization include crowns, bridges, dentures, orthodontics, periodontal surgery, and implants. Create a reference guide for the insurance companies you work with most frequently, listing their pre-authorization requirements. When in doubt, it’s safer to request pre-authorization than to assume it’s not needed, as performing services without required pre-authorization can result in complete claim denial.

What’s the best way to verify dental insurance benefits?

The most reliable method is to use real-time electronic eligibility verification tools integrated with your practice management system or available through your clearinghouse. These tools connect directly to insurance company databases to provide current coverage information. Verify benefits before every appointment, not just at the initial visit, because coverage can change due to job changes, plan modifications, or policy cancellations. At minimum, verify patient eligibility, coverage effective dates, deductible amounts and what’s been met, annual maximum benefits and remaining balance, frequency limitations for common procedures, coverage percentages for different service categories, and waiting periods for major services. Document all verification efforts including date, method, and representative information.

Why was my claim denied for “missing tooth clause”?

The missing tooth clause is a common insurance policy provision that excludes coverage for replacing teeth that were missing before the patient’s coverage began. If a patient needs a bridge, implant, or denture to replace teeth that were already missing when their policy started, the insurance may deny the claim under this exclusion. This applies even if the teeth were lost years ago. The missing tooth clause is designed to prevent people from obtaining insurance specifically to cover pre-existing conditions. Some plans have eliminated this clause or only apply it for a limited time. When planning prosthetic treatment, always verify whether the patient’s plan includes a missing tooth clause and inform patients upfront if their replacement teeth may not be covered.

How can I reduce my practice’s claim denial rate?

Reducing denial rates requires a comprehensive approach addressing multiple areas. First, implement real-time eligibility verification before every appointment to catch coverage issues early. Second, invest in ongoing staff training on proper coding, documentation requirements, and insurance-specific guidelines. Third, establish a claims review process where a second person checks claims for accuracy before submission. Fourth, use claim scrubbing software to identify errors automatically. Fifth, document treatment thoroughly including clinical notes, radiographs, and narratives supporting medical necessity. Sixth, track and analyze your denial patterns to identify recurring issues and target improvement efforts. Seventh, file claims promptly within 24 to 48 hours of service to avoid timely filing issues. Finally, consider partnering with a professional dental billing service if internal resources are insufficient to maintain consistently low denial rates.

What documentation do I need to support a crown claim?

Crown claims typically require comprehensive documentation to demonstrate medical necessity. Include pre-operative radiographs showing the tooth condition, clinical notes describing why a crown is necessary such as extensive decay, large existing restoration, cracks, or root canal treatment, documentation of any previous restorative attempts, notation of tooth number and surfaces involved, and if applicable, photographs showing the clinical situation. For implant crowns, include documentation of the implant placement and healing. The clinical notes should clearly explain why a less expensive alternative like a filling is not adequate. Many denials for crown claims result from insufficient documentation of medical necessity, so thorough records are essential even though the procedure itself is covered by most plans.

Should I file insurance claims electronically or on paper?

Electronic claim submission is strongly preferred and should be used whenever possible. Electronic claims process faster, typically within seven to fourteen days compared to four to six weeks for paper claims. They have lower error rates because clearinghouses perform automated validation before submission. Electronic claims are easier to track with real-time status updates. They reduce administrative costs by eliminating printing, postage, and manual handling. They’re less likely to be lost or delayed. Most insurance companies now require or strongly encourage electronic submission, and some impose penalties or processing delays for paper claims. The only situations requiring paper claims are when attachments like narratives, radiographs, or periodontal charting must be included, though increasingly these can be submitted electronically as well. If your practice still files paper claims regularly, transitioning to electronic submission should be an immediate priority for improving claim processing efficiency.

How long should I wait before following up on an unpaid claim?

Standard practice is to follow up on unpaid claims after 30 days from submission. Most claims are processed within 14 to 30 days, so waiting a full month allows adequate processing time while preventing excessive delays. However, track claims more closely during the first two weeks to identify immediate rejections or errors that need correction. Set up aging reports in your practice management system showing claims at 30 days, 60 days, and 90+ days. Claims reaching 60 days without payment require urgent follow-up, as they may be lost or stuck in processing queues. Claims at 90+ days should be treated as high priority with escalation to supervisors or appeals departments. Remember that timely filing limits continue running during this time, so you can’t wait indefinitely. Establish a systematic follow-up schedule and assign responsibility for claim tracking to prevent claims from falling through the cracks.