As another year draws to close, dental practices face a critical transition period that can significantly impact revenue cycles, patient satisfaction, and operational efficiency. Understanding and preparing for end-of-year insurance changes isn’t just good practice management; it’s essential for maintaining healthy cash flow and delivering exceptional patient care.

Why End-of-Year Insurance Changes Matter to Your Dental Practice

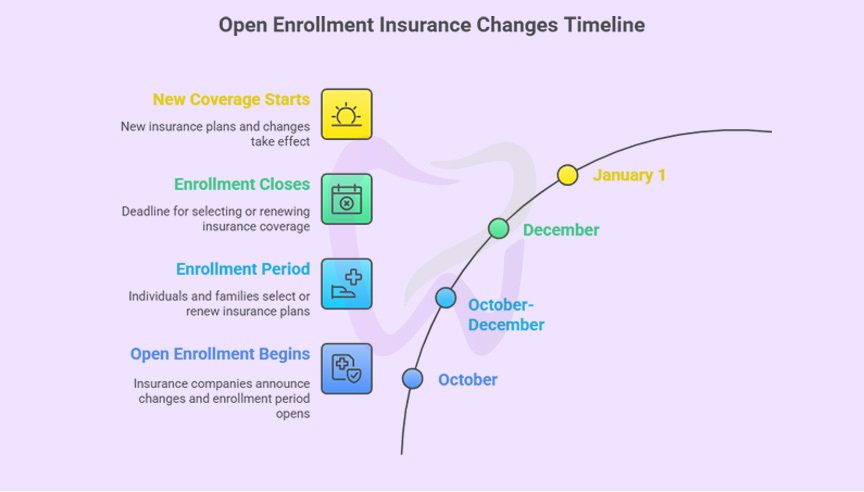

The period between October and January represents one of the most complex times for dental billing. Insurance plans reset, benefits expire, and patients scramble to use remaining coverage before it disappears. For dental practices, this creates both opportunities and challenges that require strategic planning and proactive communication.

Key statistics every practice should know

- Approximately 70% of patients don’t use their full dental benefits each year

- Dental practices typically see a 30-40% increase in appointment requests during November and December

- Insurance verification errors increase by nearly 25% during open enrollment periods

- Practices that proactively communicate year-end deadlines see 15-20% higher production in Q4

Understanding the Major Insurance Changes at Year-End

Annual Maximum Resets

Most dental insurance plans operate on a calendar-year basis, meaning annual maximums reset on January 1st. The typical annual maximum ranges from $1,000 to $2,000 per patient, though some plans offer higher limits.

What this means for your practice

- Unused benefits don’t roll over; patients lose them permanently

- Patients who’ve already met their deductible will face a new deductible in January

- Complex treatments spanning the year-end can be strategically scheduled to maximize two years of benefits

Action item: Review your schedule for September through December to identify patients who haven’t used their benefits and those with pending treatment plans.

Deductible Resets

Individual deductibles typically range from $25 to $100, while family deductibles can reach $150 to $300. When the calendar flips to January, these reset to zero meaning patients must meet them again before insurance coverage begins.

Strategic consideration: A patient who’s already met their deductible in December will receive full coverage benefits. The same procedure in January means they’ll pay out-of-pocket until meeting the new deductible.

Plan Changes During Open Enrollment

Open enrollment season (typically October through December) brings significant changes:

- Network changes: Dentists may be added or dropped from insurance networks

- Coverage modifications: Procedures covered this year may not be covered next year

- Fee schedule adjustments: Reimbursement rates can increase or decrease

- Frequency limitations: Prophylaxis intervals or x-ray allowances may change

- Waiting periods: New enrollees may face waiting periods for major services

Premium and Co-Payment Adjustments

Insurance companies regularly adjust premiums, co-payments, and co-insurance percentages. A procedure that required a 20% co-pay this year might increase to 30% next year, significantly impacting patient out-of-pocket costs.

Creating Your Year-End Preparation Timeline

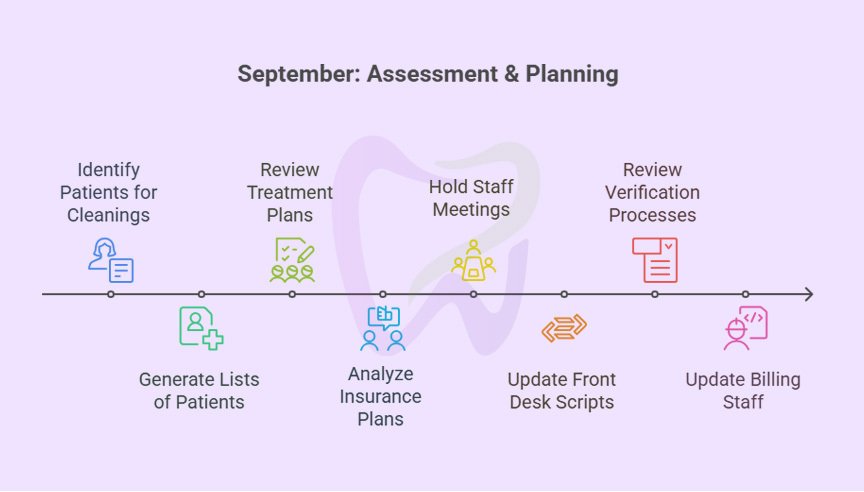

September: Assessment and Planning

Week 1-2: Data Analysis

- Run reports identifying patients who haven’t scheduled their bi-annual cleanings

- Generate lists of patients with unused annual maximums

- Review pending treatment plans that could be completed before year-end

- Analyze which insurance plans your practice participates with and any known changes

Week 3-4: Team Training

- Hold staff meetings to review year-end procedures and communication strategies

- Update scripts for front desk staff regarding benefits and scheduling

- Review verification processes to ensure accuracy during high-volume periods

- Ensure billing staff understands new codes or coverage changes for the upcoming year

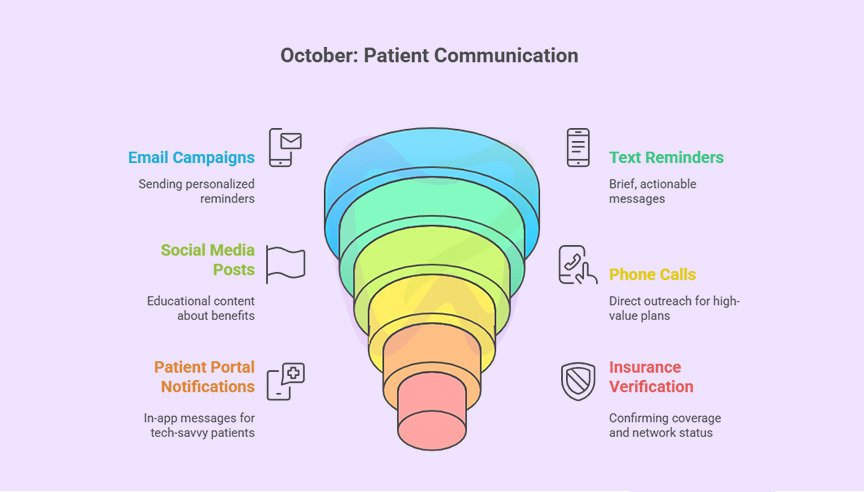

October: Patient Communication Campaign

Early October: Initial Outreach Launch your year-end benefits campaign through multiple channels:

- Email campaigns: Send personalized emails reminding patients of unused benefits

- Text message reminders: Brief, actionable messages about expiring coverage

- Social media posts: Educational content about annual maximums and deductibles

- Phone calls: Direct outreach for high-value treatment plans

- Patient portal notifications: In-app messages for tech-savvy patients

Mid-to-Late October: Insurance Verification Enhancement

- Implement additional verification checkpoints for all scheduled appointments

- Confirm coverage details for appointments scheduled in December and early January

- Verify network participation status for the upcoming year

- Check for any changes in coordination of benefits (COB)

November: High-Volume Management

Scheduling strategies:

- Block additional hygiene appointments for preventive care

- Extend office hours, if possible, to accommodate demand

- Create a waitlist for cancellations

- Prioritize patients with significant unused benefits for complex procedures

Verification protocols:

- Verify benefits within 48 hours of appointments (not just at scheduling)

- Double-check annual maximums to ensure benefits haven’t been exhausted

- Confirm authorization requirements haven’t changed mid-year

- Document all verification details with date, time, and representative name

Patient financial conversations: Equip your team with talking points for common scenarios:

Scenario 1: Patient has met deductible and has unused maximum “Great news! You’ve already met your deductible for this year, so your insurance will cover [X%] of today’s treatment. You also have $[amount] in unused benefits that will expire December 31st. Would you like to discuss any treatment we’ve been planning?“

Scenario 2: Patient hasn’t met deductible but has unused maximum “Your insurance shows $[amount] in available benefits before year-end. Since you haven’t met your $[amount] deductible yet, you’d pay that first, then insurance covers the rest. In January, you’ll have a fresh deductible to meet. Many patients prefer completing treatment in December to maximize their current benefits.“

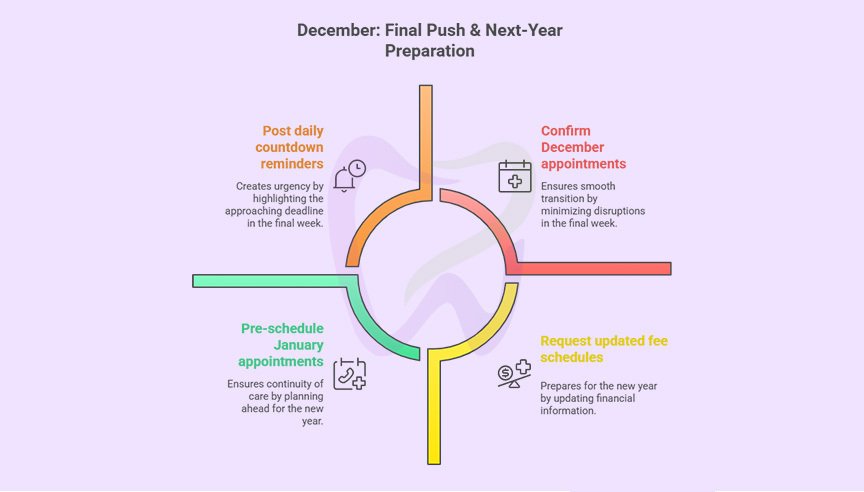

December: Final Push and Next-Year Preparation

First Two Weeks: Urgency Messaging

- Send final reminder communications emphasizing December 31st deadline

- Make “last-minute availability” calls to patients on your benefits-unused list

- Post daily countdown reminders on social media

- Consider offering extended hours for the final week

Mid-December: New Year Preparation

- Request updated fee schedules from insurance companies for January 1st

- Update your practice management software with new CDT codes

- Review and update your fee schedule if needed

- Prepare team for questions about new deductibles and plan changes

Final Week: Transition Planning

- Confirm all December appointments to minimize no-shows

- Pre-schedule January appointments for continuity of care

- Process as many claims as possible before the holiday break

- Back up all patient and financial data

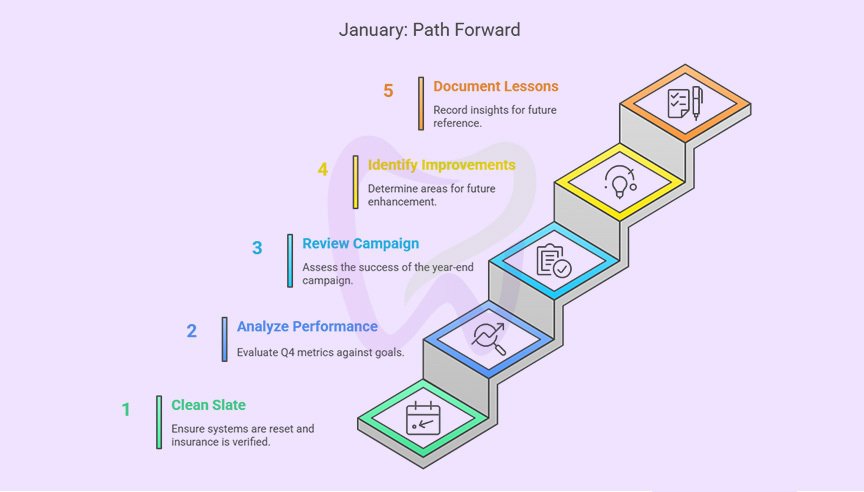

January: New Year Implementation

Week 1: Clean Slate

- Verify that your practice management system has properly reset annual maximums

- Begin the year with fresh insurance verifications for all scheduled patients

- Review any claim denials from late December that may need resubmission

Week 2-4: Analysis and Adjustment

- Analyze Q4 performance metrics against goals

- Review what worked well in your year-end campaign

- Identify areas for improvement for next year

- Document lessons learned while they’re fresh

Managing Specific Insurance Scenarios

Patients with Two Years of Benefits for One Treatment

For expensive procedures like crowns, bridges, or implants, strategic timing can maximize insurance benefits:

Example scenario:

- Patient needs a crown estimated at $1,200

- Insurance covers 50% after deductible ($600)

- Patient has $800 remaining in annual maximum for current year

- Patient has already met current year’s $50 deductible

Optimal strategy:

- Complete the preparation appointment in December (use current year benefits

- Schedule the seating appointment in January (use new year benefits)

- Patient maximizes coverage from both benefit years

Important considerations:

- Verify the insurance company allows split billing across calendar years

- Document the treatment plan clearly showing phases

- Communicate the financial benefits to the patient in writing

- Submit pre-authorizations if required to confirm coverage

Handling Plan Changes and Network Status

When patients notify you of insurance changes:

Immediate actions:

1. Obtain new insurance information including effective dates

2. Verify network participation status with the new plan

3. Check if the new plan has different coverage levels or limitations

4. Update patient records in your practice management system

5. Provide the patient with an estimate under the new plan

Coordination of Benefits (COB) Complications

Year-end changes often affect COB situations, especially with family coverage:

Common COB scenarios:

- Both parents change employers or plans

- Divorce or marriage changes primary coverage

- Dependent children aging out of parent plans (typically age 26)

- Medicare eligibility affecting secondary coverage

Best practices:

- Request updated COB information from all patients with dual coverage

- Verify the birthday rule still applies or if exceptions exist

- Submit claims to the correct primary carrier first

- Allow adequate processing time before submitting to secondary carriers

Training Your Team for Year-End Success

Front Desk Training Priorities

Your front desk team is the frontline for year-end success:

Essential skills:

- Confident communication about benefits and deductibles

- Ability to explain why timing matters for treatment

- Skilled objection handling

- Efficient scheduling to maximize appointment availability

- Accurate data entry for insurance information updates

Role-playing scenarios: Practice these common conversations:

1. Patient calls wanting to use benefits but can’t schedule until January

2. Patient questions why urgency matters since they have “good insurance”

3. Patient received notice of plan change and is confused

4. Patient wants to postpone treatment despite unused benefits

5. Patient disputes that their benefits are expiring

Billing Team Preparation

Your billing staff needs updated knowledge:

Focus areas:

- New CDT codes effective January 1st

- Fee schedule changes from major carriers

- Updated coverage policies for specific procedures

- Changes in pre-authorization requirements

- New claims submission portals or processes

Quality control measures:

- Claim scrubbing before submission

- Tracking submission dates versus service dates

- Monitoring year-end claim volumes

- Following up on aged receivables before year-end

- Preparing for January deductible amounts on patient balances

Clinical Team Engagement

Your clinical team plays a crucial role:

Dentist responsibilities:

- Reviewing pending treatment plans for completion priority

- Discussing treatment timing with patients during exams

- Staying flexible with scheduling for high-value cases

- Supporting team efforts with personal outreach to key patients

Hygienist engagement:

- Identifying patients overdue for preventive care during appointments

- Educating patients about benefits during cleanings

- Encouraging treatment plan acceptance

- Building value for continuing care into the new year

Common Pitfalls to Avoid

Mistake #1: Starting Communication Too Late

Many practices don’t begin year-end outreach until November, missing the critical September-October planning window when patients can still schedule conveniently.

Solution: Begin patient education in September and maintain consistent messaging through December.

Mistake #2: Overwhelming Patients with Too Much Information

Lengthy explanations about annual maximums, deductibles, and plan changes confuse rather than motivate.

Solution: Keep messaging simple and focused on the specific action you want patients to take: “You have $X in unused benefits. Schedule by December 31st.”

Mistake #3: Neglecting to Verify Benefits Close to Appointment Date

Benefits verified in September may have changed by December if the patient had additional treatments elsewhere or plan changes occurred.

Solution: Re-verify all benefits within 48 hours of scheduled appointments, especially in November and December.

Mistake #4: Failing to Document Patient Conversations

Without documentation, disputes about what patients were told about coverage create conflicts and potential write-offs.

Solution: Document all financial conversations in the patient chart, including what was communicated about benefits, estimates provided, and patient agreement.

Mistake #5: Ignoring January Planning

Practices focus so heavily on December that they fail to prepare for the January reset, leading to patient confusion and lower acceptance rates.

Solution: Begin educating patients in December about their new deductibles and benefits for January, setting expectations early.

Mistake #6: Over-Scheduling Without Capacity

Booking too many appointments without adequate staff or chair time leads to rushed appointments, overtime costs, and staff burnout.

Solution: Realistically assess capacity and add strategic hours rather than overloading existing schedules.

Mistake #7: Pressure Tactics That Damage Relationships

Aggressive sales approaches or making patients feel guilty about unused benefits can harm long-term relationships.

Solution: Frame communications as helpful reminders and patient advocacy, not pressure. Respect patient decisions while ensuring they have complete information.

Maximizing Practice Revenue While Maintaining Patient Care Standards

Ethical Considerations

While year-end represents a revenue opportunity, maintaining ethical standards is paramount:

Best practices:

- Only recommend treatment that’s clinically necessary

- Present all treatment options, not just the most expensive

- Respect patient financial situations and constraints

- Provide accurate benefit estimates, not inflated coverage claims

- Offer payment plans for necessary treatment regardless of insurance timing

Red flags to avoid:

- Recommending unnecessary treatment just to use benefits

- Misrepresenting coverage levels to encourage acceptance

- Pressuring patients into treatment they’re uncomfortable with

- Rushing treatment that should be carefully considered

- Providing different quality of care based on insurance status

Balancing Production Goals with Patient Experience

High-quality patient care should never be sacrificed for production:

Strategies for balance:

- Maintain appointment time standards even during busy periods

- Don’t rush exams or hygiene appointments to fit more patients

- Ensure adequate staff support for increased patient volume

- Provide the same attention to all patients regardless of treatment value

- Honor your practice’s clinical protocols and standards

Financial Policy Clarity

Clear financial policies prevent misunderstandings:

Essential policy components:

- Payment expectations at time of service

- Insurance claim processing timeline

- Patient responsibility for insurance errors

- Deductible and co-payment collection procedures

- Payment plan options and approval process

- Cancellation and no-show policies

Year-end specific policies: “Please note: Due to high demand in November and December, we require 48-hour notice for cancellations or rescheduling. Appointments cancelled with less notice may result in a fee, as we likely cannot fill that time slot with other patients trying to use their year-end benefits.”

The Role of Professional Billing Services

When to Consider Outsourcing

Managing year-end insurance changes while maintaining high-quality patient care can overwhelm in-house billing teams. Professional dental billing services like TransDental offer significant advantages during this critical period:

Capacity and expertise

- Dedicated teams focused solely on billing and verification

- Experience handling high-volume periods efficiently

- Up-to-date knowledge of insurance changes and requirements

- Ability to scale resources during peak seasons

Technology advantages

- Advanced software for eligibility verification

- Automated claim scrubbing reduces denials

- Sophisticated reporting for strategic decision-making

- Integration with practice management systems

Financial benefits

- Faster claim submission and follow-up

- Higher clean claim rates reduce delays

- Expert denial management improves collections

- Reduced administrative costs and overhead

Practice focus

- Clinical team focuses on patient care, not billing issues

- Front desk concentrates on patient experience and scheduling

- Reduced staff stress during high-volume periods

- More time for patient communication and treatment planning

How TransDental Supports Your Year-End Success

TransDental’s specialized services are designed to help dental practices navigate year-end challenges:

Proactive benefits management

- Comprehensive benefits verification for all scheduled patients

- Identification of patients with unused annual maximums

- Strategic treatment planning support to maximize benefits

- Real-time eligibility checking to prevent surprises

Enhanced claims processing

- Priority processing for year-end claims

- Expert coding to reduce denials

- Rapid follow-up on outstanding claims

- Transparent reporting on claims status

Patient financial communication

- Clear benefit explanations for your team to share with patients

- Accurate treatment estimates considering current and new-year benefits

- Support for complex coordination of benefits scenarios

- Patient-friendly billing statements

Strategic practice support

- Analysis of production and collection patterns

- Recommendations for optimizing year-end scheduling

- Custom reporting to track year-end campaign success

- Training and support for your administrative team

Conclusion: Setting Your Practice Up for Year-End Success

Successfully navigating end-of-year insurance changes requires strategic planning, proactive communication, and efficient operational execution. By implementing the strategies outlined in this guide, your practice can:

- Maximize revenue during the critical Q4 period

- Improve patient satisfaction through helpful, timely communication

- Reduce billing errors and claim denials

- Position your practice for a strong start to the new year

- Build lasting patient relationships based on education and advocacy

The key to success lies in early preparation, consistent patient communication, robust verification processes, and maintaining high standards of care regardless of production pressure.

Your action plan starts today:

1. This week: Review your current year-end preparation level and identify gaps

2. This month: Implement enhanced verification protocols and begin patient communication

3. Next 90 days: Execute your comprehensive year-end strategy with regular team check-ins

4. January: Analyze results and document improvements for next year

Remember, year-end insurance changes aren’t just administrative challenges—they’re opportunities to demonstrate your practice’s commitment to patient education, financial transparency, and exceptional care. Patients who feel supported and informed during this complex time become loyal advocates for your practice.

Frequently Asked Questions (FAQs)

When should we start communicating with patients about year-end benefits?

Begin initial communication in September, with increased frequency through October, November, and December. Early outreach allows patients to plan and schedule conveniently.

How do we handle patients who want to schedule in January instead of December?

Educate them about the financial impact of deductible resets and annual maximum losses. Provide specific dollar comparisons showing potential savings with December treatment. Respect their decision but ensure they have complete information.

What if we verify benefits but the insurance company pays differently than stated?

Document all verifications thoroughly, including representative name, reference number, and date. If discrepancies occur, file appeals with the insurance company using your verification documentation. Have clear policies about patient responsibility for insurance errors.

Should we extend office hours during November and December?

If you have adequate staff and patient demand, strategic hour extensions can significantly boost production. Consider early morning, evening, or Saturday hours. Ensure staff compensation is fair for additional hours.

How do we prevent staff burnout during the year-end rush?

Plan ahead with realistic capacity assessments, consider temporary staff support, maintain appointment time standards, celebrate successes, and provide appreciation for the team’s extra efforts. Don’t sacrifice long-term team health for short-term production gains.

What’s the best way to track unused benefits for our patient base?

Use your practice management software’s reporting capabilities to generate lists of patients with unused annual maximums. Most systems can sort by dollar amount, allowing you to prioritize high-value outreach. Update these reports monthly as patients come in for care.

How do we handle coordination of benefits during year-end changes?

Request updated COB information from all dual-coverage patients in October. Verify primary coverage hasn’t changed due to employment changes, marriage, divorce, or dependent age-outs. Submit claims to the correct primary carrier first and allow adequate processing time before secondary submission.

Should we require payment at time of service during the year-end rush?

Clear financial policies about payment expectations prevent misunderstandings. Many practices do require payment of estimated patient portions at service, especially during high-volume periods when claim processing and collection becomes more challenging. Communicate policies clearly and consistently.

How can we reduce no-shows and cancellations in December?

Use multiple reminder systems (email, text, phone), confirm appointments 48 hours in advance, communicate the difficulty of rescheduling during peak season, consider implementing a cancellation policy, and make it easy for patients to reschedule as early as possible if needed.

What should we do if we can’t accommodate all patient requests for year-end appointments?

Be transparent about availability, create a cancellation waitlist, consider strategic hour extensions, prioritize based on clinical need and benefit amounts, and help patients understand their options. Some treatments can strategically span the year-end to use benefits from both years.